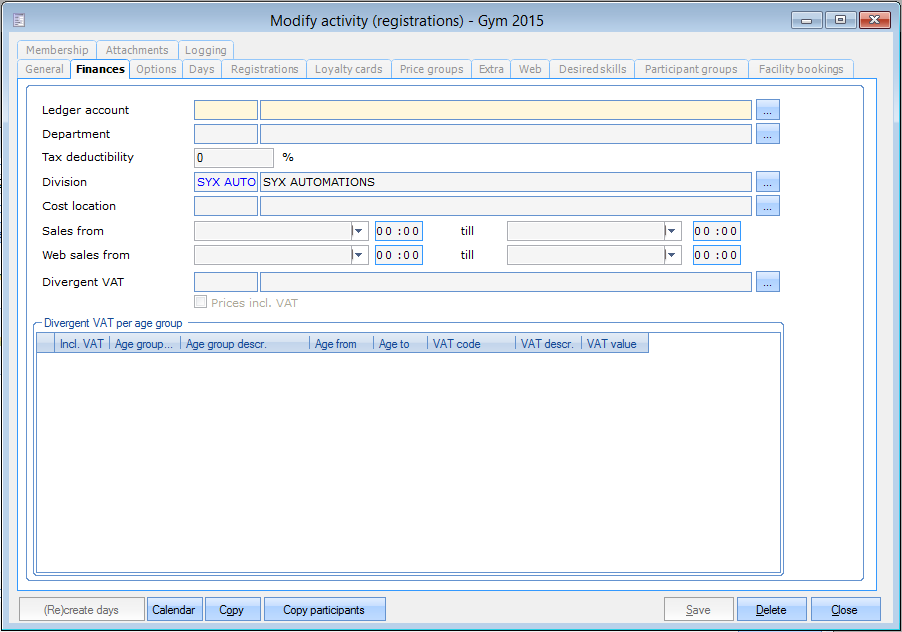

Finances

The tab Finances contains all financial data of the activity.

|

Ledger account | This is the ledger account that is linked to this activity. |

Department | This is the article department with linked cost centre and analytical account on which this article has to be recorded by the accounting division. |

Tax deductibility | Here you can determine which percentage of the registration fee is defined as fiscally deductible. The maximal amount of tax deductibility can be defined in the parameters (see 'Parameters'). |

Division | This is the division where the activity will be recorded. If a new activity is created, the division is automatically filled in based on the division in which one is currently working. |

Cost location | This is the cost location on which registrations for this activity have to be recorded by the accounting department. |

Sales from... till... | If you define a period here, customers will only be able to register for this activity during this period. In other words, you can define the registration period here. It will not be possible to register for this activity before or after this period. This is taken into account on different levels: in Accelerated registrations, Loyalty pass, and Day registrations. Activities of which the registration period is not within the current date will simply not appear in the list of available activities, and if you want to register at the POS or through Registrations (comprehensive) outside the allowed registration period, the message It is currently not allowed to register for this activity! will appear. |

Web sales from... till... | If you define a period here, customers will only be able to register online for this activity during this period. This activity will be available before and after the registration period within the activities offered on the website (if the option Show on website; tab General is ticked off), but if you, however, try to register outside the registration period, a message will appear. |

Divergent VAT | If you want to, you can select a VAT code for this activity that diverges from the VAT code defined in the activity parameters. Once you have chosen a divergent VAT tariff, you can also decide if the activity prices used are including or excluding VAT. | |

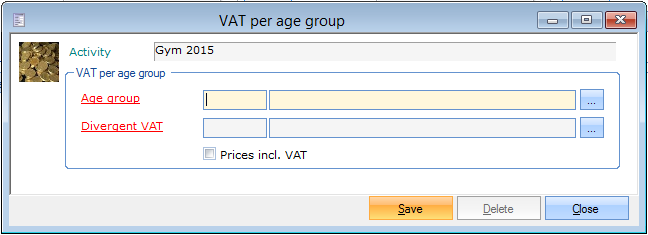

Divergent VAT per age category | If you want to, you can use divergent VAT codes per age category in this list. You can create, modify or delete lines with a divergent VAT code per age category at all times (see manual 'FRAMEWORK'Framework)).

|