Fiscal certificate

Recreatex allows you to create fiscal certificates for children who participated in your activities. The customer can then add the fiscal certificate to his/her tax declaration and, in this way, enjoy a certain tax reduction for child care.

To receive a fiscal certificate, several conditions have to be met:

The participant's birth date has to be filled in (customer address card) and the age can not be higher than 12 years old on the moment of the registration

On the activity level, tab Finances, a percentage higher than 0 has to be filled in in the field Tax deductibility.

The customer must have been present at the activity. The presence can be checked/modified under Registrations > Visualisations > Presences per activity.

The price of the registration must be higher than 0.

The registration must be recorded, and if the parameter Only for fully paid registrations is enabled, the registration must be fully paid.

Note

Fiscal certificates are issued to the head of the family to whom the child is linked.

In divorced families, a child may be linked to both parents, each as head of a family. In such cases, the fiscal certificate is issued to the child's Invoice customer, as specified in the tab Invoicing of the customer address card.

Go to Activities > Reports > Fiscal certificate.

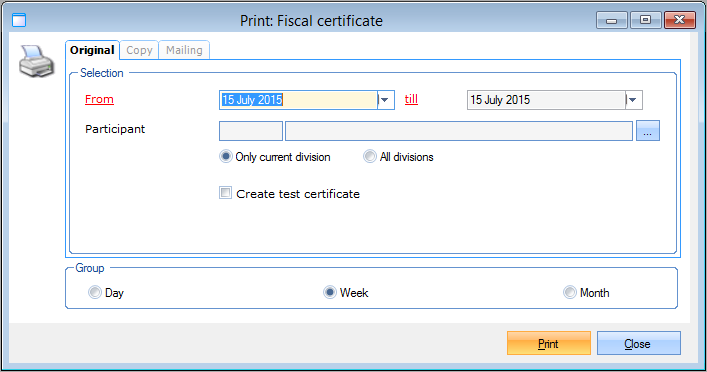

The window below will appear:

|

This window has the following tabs:

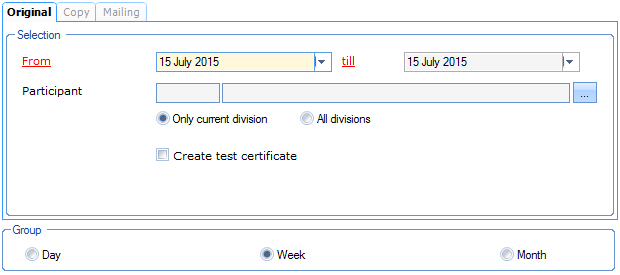

Original

In the tab Original you can create new fiscal certificates.

|

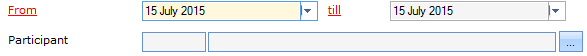

In the section Selection you have to determine the period in which the activities for which you want to create fiscal certificates take place. It is also possible to select a specific participant.

|

Moreover, you can choose to generate the fiscal certificates of the current division only or of all divisions, and indicate if you want to create test certificates first or not.

|

Note

Since a fiscal certificate is an official document with a unique order number, we advise to always first print a test version when creating new fiscal certificates (tick off setting Create test certificate and then click on print) before generating the official certificates.

Finally, you have to determine in the section Group if the period in which the child was cared for has to be split up per day, per week or per month.

|

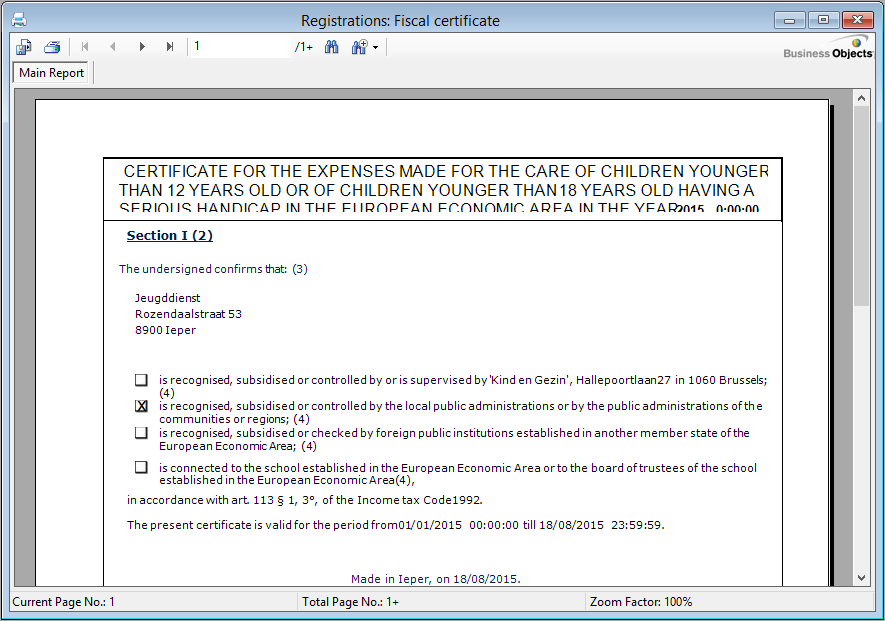

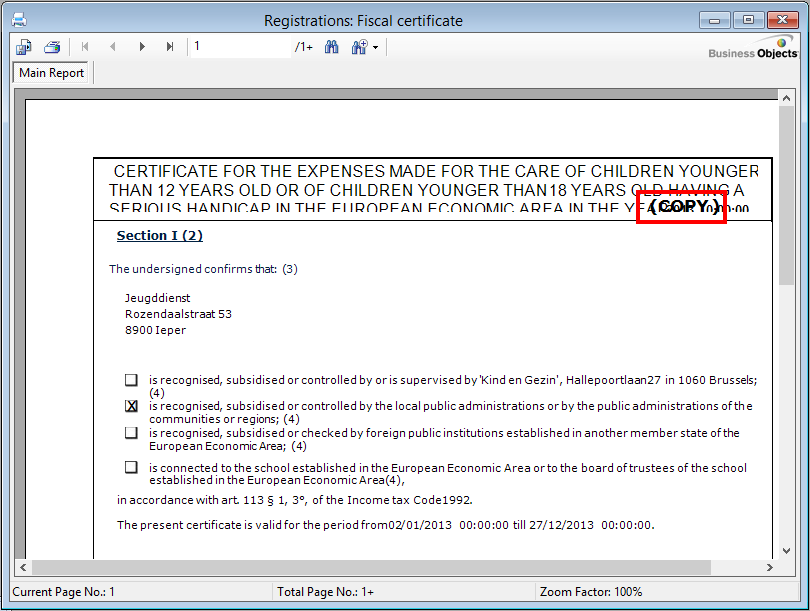

If you have determined the selection criteria, you have to click on Print after which the required fiscal certificates will be created, for example:

|

Copy

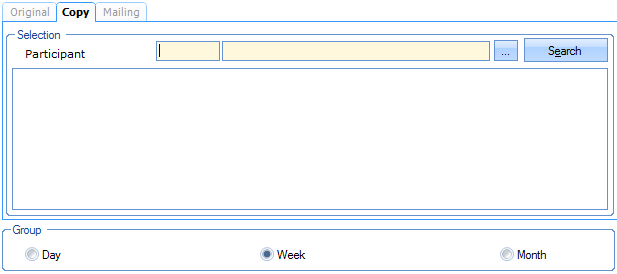

In the tab Copy you can generate copies of new fiscal certificates that have already been created.

|

If required, you can first select the specific participant of whom you want to call up the fiscal certificates already created.

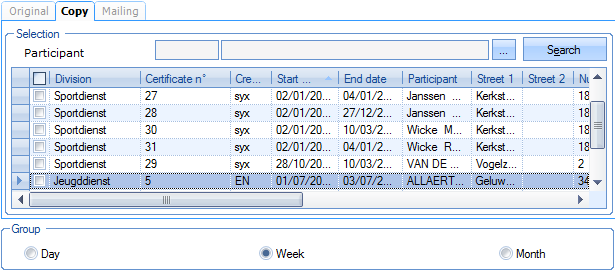

If you click on Search the fiscal certificates already created will appear, if required exclusively those of the selected participant.

|

Tick off the fiscal certificates in this list of which you want to print a copy and determine, if required, if the period in which the child has been cared for has to be split up per day, per week or per month.

Use the button Print here as well to print the desired copies.

|

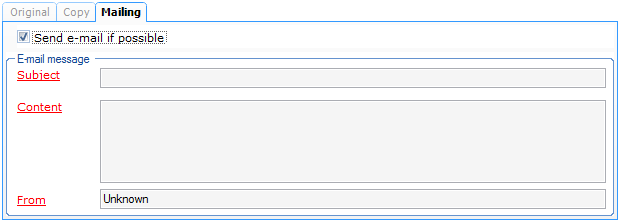

Mailing

In the tab Mailing you can define that the generated fiscal certificates are sent per e-mail to the customers in question if possible. A fiscal certificate will only be sent per e-mail to (invoice) customers if a valid e-mail address has been filled in on the customer card. The fiscal certificate is always added to the e-mail as an attachment (PDF). Only official certificates or copies are sent per e-mail: test versions will not be sent per e-mail.

Warning

Using this functionality is only possible if you have a lisense for the Recreatex module Mailing. (see Mailingmanual 'MAILING')

|

In order to use the mailing functionality for fiscal certificates, you first have to tick off Send e-mail if possible and fill in the subject, the (accompanying) content and the sender's address (initially, the address set up in the system parameters will be suggested).

If you now click on Print, the fiscal certificates or copies will be sent as an attachment per e-mail to the customers who qualify for the mailing. Customers that do not have a (valid) e-mail address, will receive a printed version of their fiscal certificate.

All e-mails with fiscal certificates will be put in the queue of the Mailing module, where these e-mails can then effectively be sent manually or by utilizing the available service, dependent on the settings. For more information, we refer to Mailingthe manual 'MAILING'.